Is Spain the Best Country for Digital Nomads in 2024?

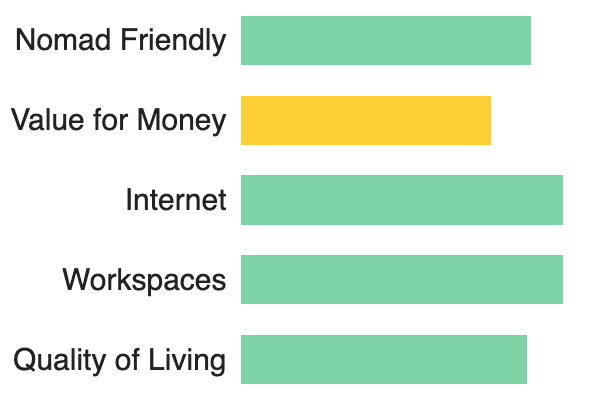

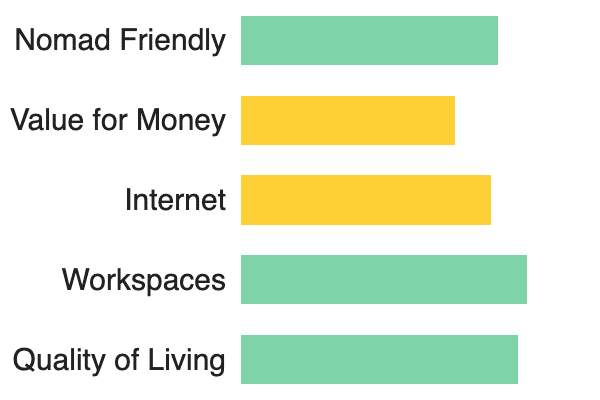

A recent Digital Nomad Visa Index on VisaGuide.World ranked Spain as the top digital nomad country in 2024 based on a number of factors including internet speed, income requirement for visa applications, cost of living in euros, and Global Health Score, to name a few. Spain received an index score of 4.5 out of 5.0 with Argentina coming in second place with a score of 3.78/5 and Romania taking the third spot with 3.74/5.

Spain launched their digital nomad visa program as part of their new Startup Act in January 2023. Requirements to apply include having an income of double the Spanish minimum wage of around 1,260 € (or $1,340) a month, private health insurance, a one-year employment contract outside of Spain, and a college degree or at least three years of work experience in their field.

Spouses and families can also join successful applicants, but this will require proof of higher wages. For one additional family member, applicants need to show an additional 75% of Spain’s minimum wage per month (about $1,000 more). Each subsequent dependent requires 25% more, or about $335 per family member. Spain’s digital nomad visa initially lasts for one year and is renewable for up to five years.

Spain Tax Obligations

Unlike the other countries in the top 5 of the Digital Nomad Visa Index (with the UAE and Croatia rounding out the list), Spain is the only one that taxes visa holders. In order to renew their digital nomad visa in Spain, visa holders must spend at least 183 days a year in Spain. This amount of time also makes them tax residents, although taxes under the digital nomad scheme are lower than the tax rates for other Spanish taxpayers.

Digital nomads in Spain are subject to a fixed tax rate of 15% up to an amount of 600,000 € for the first four years of their residence. This is an eligible tax benefit thanks to the Beckham law, which was enacted in 2005 during David Beckham’s time playing for Real Madrid and is extended to highly paid foreign nationals. Please note that digital nomads are also subject to capital gains taxes in Spain. It is important to contact a Spanish tax advisor to understand all the facets of digital nomad tax in detail.

Digital Nomad Paradise

Despite Spain’s strict tax regime, it is also home to some of the world’s best food, a rich history, approachable language, and 12 popular islands spread across the Canaries and Balearics. With its affordable cost of living, sunny weather, vibrant culture, and ever-increasing long-distance train links, such as the recently opened Pajares rail tunnel, Spain has a lot to offer the digital nomad community and has paved the way for nomads to set up a base there.

The question is: does it deserve to be #1? Is it worth it for digital nomads making a certain amount of income to apply for digital nomad visas and get into the tax and health schemes of different countries? The number of Spain’s digital nomad visa applications in 2024 will help make the case.

Responses