Stock Trading

What is a Stock Trader?

A stock trader buys and sells shares of public companies, making profit out of the share price variations. A stock is a share of ownership in a company, a fraction of a corporation. Public companies issue shares for individuals to acquire in order to raise money for their business. You can think of it as crowdfunding for big corporations. Some shares will also pay out dividends to investors.

Share price is driven by many factors such as company results and profitability, expectations of the market (i.e. how people think a company is going to perform) and market trends. Shares constantly go up and down in price based on supply and demand.

Stock traders will try to predict stock price changes and take advantage of the short term shifts. Trading is different from investing: traders do not hold their positions for more than a few weeks or months, while investors can keep their shares for years.

Ideally, a trader wants to buy low and sell for a higher price at some point in the future. He conducts technical analysis on stock charts and fundamental analysis on the company’s health to make their buying and selling decisions.

Most advice in this article also applies to other trading markets such as Forex or Cryptocurrency.

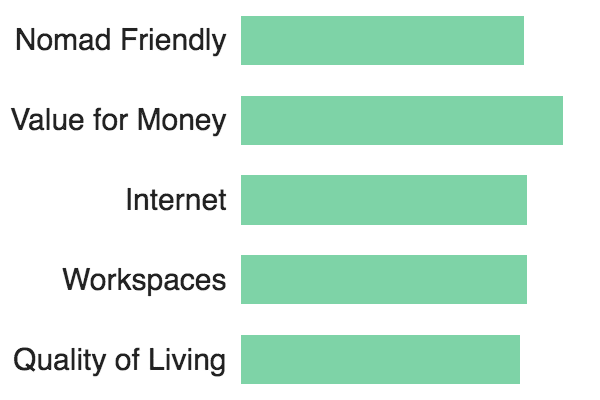

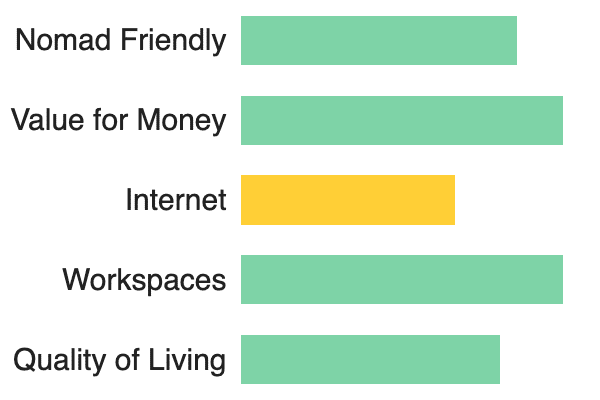

How common is being a stock trader amongst digital nomads?

Investing in assets is often more profitable than having money sitting in your bank account. These days, most stock trading can be done online and only requires a stable internet connection. For that reason, stock trading (along with other types of trading) has become increasingly popular amongst digital nomads.

Online stock trading comes with many advantages such as no timezone constraints, no troublesome clients and little time investment. You don’t even need to work within market opening hours since most trading platforms allow you to place your bids in advance.

Digital nomads like to have multiple sources of income and for many, stock trading is only a side hustle. However, some digital nomads do make a full time living from trading activities.

How much can a stock trader expect to make?

Historically, the stock market has a yearly return of 7% to 10%. However, it is impossible to say exactly how much a trader can make. Earnings are highly influenced by the capital initially invested, chosen trading strategy and how much risk you are willing to take with your money.

Here are a few indicators that will help you better evaluate your earning potentials:

- Risk management

Each trade you place comes with the risk of losing a portion of your money. To mitigate this risk and limit losses, make sure you place stop-loss orders where your stock is sold automatically if it reaches a certain price. For example, if you buy stock at $10 USD with a stop-loss at $8 USD, you are risking $2 USD on this trade.

As a rule, never risk more than 2% of your trading capital, that means if you have a $1,000 USD capital your trade should be $20 USD.

- Trading strategy

There are hundreds of different approaches to stock trading based on the time period of trade. The three most popular styles amongst digital nomads are scalping, day trading and swing trading.

Scalpers only hold their position for a few seconds or minutes, multiplying small quick trades with low profit. It is a very intense and fast paced style of trading. Day traders also enter and exit their positions on the same day, they hold positions open for a few hours, allowing more time to analyse the market and take action. Swing traders can hold their positions overnight to capture longer term market moves. Some digital nomads also use algorithmic trading platforms that automate trading entries and exits.

Select a trading style that suits your personality and lifestyle and stick to it for better results.

Where do I start if I want to become a stock trader?

Stock trading is not a race, it’s a marathon. You cannot learn trading in a few weeks, it takes a lot of discipline, training and patience to become a successful trader. Here is how to get started:

- Chose a broker and open a trading account – If you want to trade stocks as a digital nomad, you’re going to need an online broker. Brokerage firms hold your investments and place your trades on the market. It’s important to choose the right broker. As a beginner, you should look into the commission rate per trade, customer support, ease of use of the interface, but also educational resources available on the platform.

- Learn to analyze charts – The study of price charts is called technical analysis. It is key to master this discipline and determine when to buy and when to sell your positions based on statistical trends such as trade volumes and price movements. Most of the time, short time traders will only rely on technical analysis to detect patterns and identify trading opportunities.

- Practice with a demo account – Before risking real money on your trades, you can practice with a training account. Most trading platforms offer this type of account that is funded with fake money and allows you to place trades on a simulated stock market.

Short conclusion

Online trading jobs for Digital Nomads come with the promise of high reward with minimal effort. However, even if you invest the time, effort and money, there is no guarantee that you will be profitable. The reality is that amateur traders are competing with industry professionals and algorithms, most beginner traders lose money for the benefit of more experienced traders.

If you trade, you will find yourself in losing positions and this applies to all traders. How you react to losses is more important than the loss itself. It takes a lot of discipline and control over your emotions to become successful and improve your trading psychology.

Online trading is not for everyone and has a lot to do with your relationship with money. However, if you want to become a digital nomad, you have to adopt a “leave no stone unturned” mindset, it’s always worth giving it a try with a demo account to test your potential.

Responses