Stock Day Trading

What is Day Trading?

Day trading is a type of market speculation where you invest in a stock and then sell it on the same day. It’s growing in popularity with traders across the world as it comes with less risk and allows you to invest in several stocks at once. It’s also one of the easiest types of trading for complete newbies to get into as you can pick up the required skills quite quickly.

With low risk comes low reward but this doesn’t mean you can’t make serious money with day trading. Usually you will invest in more than one stock each day, giving you much larger returns. It will take you at least a couple of months to make a serious return on investment but this is still far quicker than other forms of financial investment.

It also isn’t restricted to stocks in businesses! Anything that can be traded on the financial market can also be invested in by day traders. This includes foreign currency (known as Forex), futures and cryptocurrency. Investing in cryptocurrency is actually why day trading has seen such a big resurgence over the past few years.

Until the 70s day trading was restricted to professional traders but years of deregulation has seen it open up to the general public. There are still some rules and regulations about what you can and can’t do, so it’s important to learn about all of this before you start. That being said, you can easily do it from your bedroom and make a quick buck.

How is day trading used in the financial market?

Whenever you buy a stock you are given a certain share in that business (or value against a currency or future). This can then be traded later on when the value of that share is worth more money. In traditional stock trading you hold onto your share for a few months or even years. This allows you to make money in dividends but comes with an added risk.

The less risk involved in financial trading the better, which is where day trading comes in. Usually day traders will buy a stock as soon as the markets open – and sell it again before the markets close for the day. Stocks are more stable when the market is open with most of the dramatic changes occurring overnight. This means you won’t make a huge income but you also don’t have to worry about making a massive loss.

This low risk form of trading has attracted newbie traders for years now but it has recently boomed in popularity. Forex trading, in particular, is becoming increasingly popular as you’re more likely to see larger returns from day trading. Cryptocurrencies offer particularly high rewards if you trade them right as these can rocket in value in the space of just a day.

Day trading is somewhat restricted in the financial markets but this really depends on what country you’re in. In the United States, you can start with a maximum of $25k in your account, which also restricts how much money you can make. That being said, it’s also free from some other regulations. Financial interest is usually applied overnight, so day traders aren’t subject to it in the same way as other traders.

How to become a stock day trader?

There are three important things you need to become a day trader – knowledge, capital, and strategy. There are numerous ways to pick these up but keep in mind that it isn’t as easy as many people make it out. We’ve all been sent messages from random accounts on social media offering us an easy way to make money. This is simply too good to be true, so take the time to learn about day trading before you jump at an opportunity.

To gain knowledge it is best to take an online course. There are numerous articles and videos online claiming to teach you the ins and outs of day trading but this is a decades-old financial practice that you can’t just pick up overnight. Course prices vary but they’re totally worth it if you want to be successful. Of course, if you land an opportunity with a large firm you can also have these courses paid for you but do your due diligence and make sure you aren’t being scammed.

Speaking about large firms, this is usually how you get your capital. As a digital nomad we’re going to assume you don’t have a large amount of savings to invest so you’ll have to invest using someone else’s money. These large firms have been at it for years and know what they’re doing, and they’ll want you to have the same level of knowledge.

Once you have the capital you can’t just trade at random and hope it works out (otherwise it’s just gambling) so you need to build a solid strategy. This involves keeping up with the industry. If you’re working with a large company you’ll likely be trained in their strategy but it’s still handy to have a solid idea of what you’re doing for yourself. You also need a little bit of discipline to stop yourself from getting caught up in the markets. It still has a hint of gambling – even with a solid strategy – so make sure you don’t get so addicted that you lose everything.

What jobs require knowing stock day trading?

It is a job in its own right and is separate from other forms of financial market trading. If you’re low on experience it’s better to take a role at a larger firm. In these kinds of roles you will be given a certain amount of money and expected to trade using your own skills and expertise. The amount of money you make is then shared between the company and yourself.

Once you have a little more experience (and capital) you can then opt to do it for yourself. A big warning here though – the big companies have super effective (and expensive) equipment and software to help make things a bit easier for you. You’ll get to keep more of the money for yourself this way but you’ll also weather the costs yourself (including any losses). This isn’t something you should consider unless you have money to burn and heaps of experience.

Investment bankers also dabble in day trading but the low returns mean it isn’t a huge part of the job. Nevertheless, it is a quick way to make money and comes with slightly lower risk so you shouldn’t rule it out. It’s worth learning about day trading and how it works, as this will impact your own regular stocks, shares, and investments.

Whatever route you go down you’ll need to keep in mind that this is a full time job. You simply won’t make any meaningful income without investing a lot of time into it. This is why it is so off-putting for a lot of people – as your income isn’t totally guaranteed and you could invest all that time for nothing. This is why it’s important to make sure you know your stuff before you dive in.

Average day trading income (and does experience matter)?

So there isn’t a salary for this – it depends on what you can make. For this reason we don’t want to give you a guarantee. You could make thousands of dollars one day, and lose money the next. Even if you are working for someone else, you will be sharing your income with the company rather than making a salary.

That being said we can give you a rough idea of average incomes. The average income is around $3,750 when you’re first starting out but this isn’t entirely full time as you are only working 20 days per month at that rate. Full time you can usually exceed $4,000/month. Think of it as around $37.50 per trade on average.

Those who know what they’re doing can look to earn around $50-75k per year but this is generally for the most successful traders. Experience isn’t totally necessary here, but it can definitely help. When you get used to how the markets work and build a solid strategy you will see your income increase significantly.

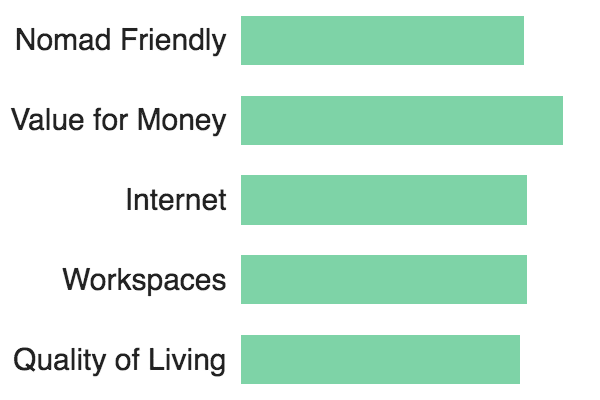

How common is using day trading amongst digital nomads?

It really depends! It’s not the most common form of income for digital nomads but it is certainly growing in popularity. Day trading is seen as a quick way to make money but many digital nomads give it up when they realise that it takes a certain level of skill.

With that in mind, we recommend learning how to do it before you start looking at companies to work with. Not only will this help you be more successful, it also gives you an idea of whether it’s something you really want to do. Day trading can be rewarding work but nothing is a given so you’ll need to be a good strategist.

Day trading is growing in popularity as it is a less risky form of investment when done right. You’ll need to learn how to build a good strategy and exercise some self-control but with the right discipline it can bring in a decent income. As with everything else, however, make sure you take the time to learn the ins and outs of day trading before you dive right in.