Remote Work and Business in Tax-friendly Madeira

As it has become increasingly popular to work remotely, certainly after the events of last year, it has been more common to work from home. Some jobs also allow a flexible schedule, which gives people the freedom to travel or live in whichever time zone they like. Because of this, it is also easier to select a preferred country to register and run your business in.

I am Tim Haldorsson, owner of the digital marketing agency for Nordic SaaS companies, Lunar Holding LDA based in Madeira, and in this article, I will tell you about my experience as a remote worker on the island. I will explain why I chose to settle my company in Madeira and give you some insights on the tax benefits.

About the Island

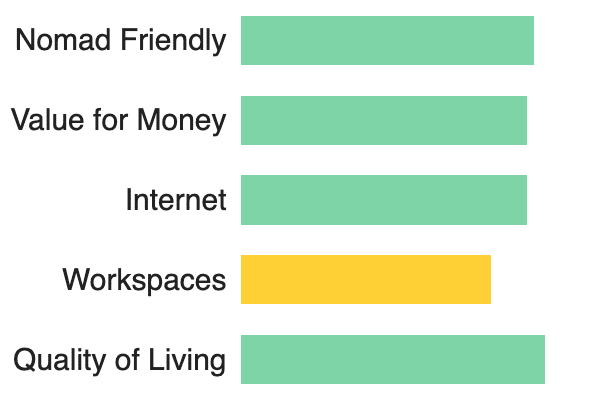

Madeira is an island which belongs to the country of Portugal, and is located in the Atlantic Ocean 978 km southwest of Lisbon, the capital. The island offers beautiful natural scenery, a mild climate, high level of safety, high quality of life, and is ideal for remote workers. Here is a large digital nomad community and specialized hospitality accommodating the nomad lifestyle.

It has been made very comfortable and easy for digital nomads, like us, to live, work, and thrive here. Within the digital nomad communities you can find great ways to meet like-minded people. Many coworking spaces with high speed internet offer certain things for free. Often the staff can help you find good deals on car or moped rentals, for example. Housing that is apt for digital nomads that might be travelling a lot can easily be arranged. Also, we often get invitations to exclusive digital nomad events, and other activities.

Further, we will dive into the possibilities and tax benefits of starting and running your company in Madeira.

Tax-friendly Economic Program in Madeira

After the economic crisis in Portugal took place, the country progressively took different approaches towards rebuilding the economy. One of the actions that were taken was forming a special economic program for inviting non-habitual residents to settle their business here for a very low taxation, which is benefiting many foreign investors.

The program further offers a wide range of incentives, primarily when it comes to taxes, that have been approved by the European Union until at least the end of 2027. The legal aspects continue to be firmly efficient and clearly structured in regards to transparency and compliance.

Madeira Tax Regulation

A Madeira-registered business can benefit from the following tax benefits:

- Income tax is reduced at 5% and is applicable to active income. (i.e. income resulting from trading activities or provision of services, etc.).

- Exemption from withholding tax on the distribution of dividends (if certain conditions are met).

- The participation exemption is also adequate to:

- Capital gains (with a minimum of 10% ownership, held for 12 months, is required).

- Sale of its subsidiaries.

- Payment of capital gains to the shareholders, by the sale of the company.

- Discharge from withholding tax on interest, service fees and royalties paid to non-residents.

- Exemption from property transfer tax, property tax, stamp duty, and regional and municipal surcharges (dependent on an 80% limitation per tax, transaction, or period).

- Application of the double taxation and investment protection treaties signed by Portugal.

Why Should You Pick Madeira for Your Business?

Madeira is as close as possible to being a tax haven without actually being one, and therefore it is not in the risk of being blacklisted or otherwise constantly surveilled. It is regulated by the EU and the Organisation for Economic Co-operation and Development (OECD). Therefore, you do not have to worry about getting fined or being subject to any other sorts of penalties that could possibly occur in tax havens.

As an established company in Madeira, you are automatically given a VAT tax number, which allows you to access the EU intra-community market. All the EU directives are applicable to the island and are guaranteeing a disciplined legal system which protects the interests of the investors.

If you want to hire people that live in Madeira or Portugal, you can definitely pick from highly educated and skilled people that would require a lower salary compared to many other countries in the EU. You can also expect lower operation and maintenance costs for your company.

The Basic Requisites for Setting up a Company in Madeira

There are some requirements that must to be met for company setup in Madeira:

- The company needs to apply for a Government Licence.

- The reduced corporate income tax rate on income (5%) is applied when the income is acquired from an international activity, for example outside Portugal, or, when in Portugal, the business relation is with another Madeira-registered company.

- The exemption of capital gains tax, applied to the sale of shares in the company, does not apply to shareholders who are considered tax residents in Portugal or within a ‘tax haven’ (defined by Portugal).

- Exemption from Real Estate Transfer Tax (IMT) and Municipal Property Tax (IMI) for properties exclusively applies for the company’s business.

Great Tax Benefits Sets the Ground for Company Growth

Now that you have been given a glimpse of how it would look like setting up a business and working in Madeira, it might be worth looking into further. Having set up Lunar Holding here and enjoying life on the island for a while, I highly recommend it for anyone who is looking to set up a business in a safe and beautiful environment.

The money that we save from these tax benefits, goes instead to providing employees with better salaries and also more attractive deals for our clients. Which in turn leads to quicker company growth and room for more possibilities.

Responses