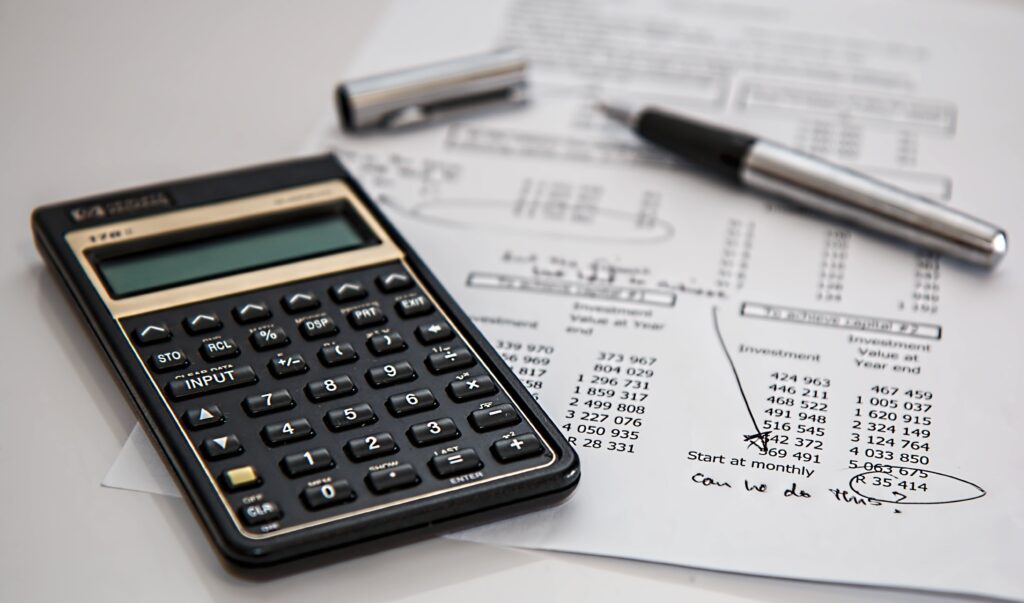

Bookkeeping and accountants for digital nomads

What Are Accounting and Bookkeeping for Digital Nomads?

Accounting and bookkeeping are essential procedures for any business. They are how a business measures its success, complies with taxation and figures out how to make further income. They are also necessary for other types of organisations – including charities, political organisations, and government bodies.

Bookkeeping is another term for the recording of financial transactions within an organisation. Quite simply, it is where you keep track of the money in and the money out. Every business needs to legally keep these records so it can figure out how much it owes in taxes. Beyond taxation, you will also use this information to figure out the best ways to make money and where to reduce costs.

Accounting is a broader field that includes bookkeeping. In general, it is how you measure how much an organisation is making and spending, presenting this information so it can be understood by relevant parties and then communicating it to anyone that needs to know. Accountants are the financial heart of the company.

The main types of accounting are financial, management, external auditing, tax accounting, and cost accounting. People who work as accountants tend to specialise in one field – though in most jurisdictions you will be qualified to work in all of them.

There are some misconceptions about accounting that prevent people from getting into it. You’ll need to have a good financial head – but that doesn’t mean it is a boring career. It really depends on what you want to get out of it. Accounting is a high demand skill with great rates of pay but this isn’t the only pull. Depending on what kind of company you work for, you can find yourself making a real impact on the world and enjoying a wide range of personal perks.

How are accounting and bookkeeping used in business?

Bookkeeping is only one process of accounting but it is arguably the most important. It is legally necessary for every business – and most other organisations. Everything you make and spend is taxed and you need to keep a record of this to make sure the organisation doesn’t end up in trouble with the tax department.

Beyond bookkeeping, accounting has a wide range of applications. Financial accounting is closely related to bookkeeping but also takes into account other parts of the business. You will need to summarise key financial trends – both internally and externally – and how these apply to the organisation concerned.

Management, cost, and tax accounting are all pretty similar in scope. Management accountants work with bosses to use financial data as a means of figuring out the next best steps for the organisation. Cost accounting is closely related to this but works exclusively with expenses. You’ll look at how much an organisation spends and figure out where to increase and decrease spending for efficiency. Tax accounting pertains specifically to taxation, which is the one big legal requirement for every organisation. Most countries require accountants to be trained in local taxation rules before they can receive accreditation.

Finally, auditing is a little bit different. Auditing is a form of accounting that is performed by an external body. Usually, this involves someone that has neither a stake in the business nor the organisation requesting the audit. Tax auditors, for example, work for government bodies to make sure companies are paying the right amount of tax. Business and government auditors, on the other hand, will make sure various departments are using their money efficiently.

How to become a digital nomad accountant?

There are a few steps to becoming an accountant, so you need to make sure it’s something you’re really set on learning. It can take years to achieve the correct qualifications, certifications and experience before you can even take on an entry-level job. You will be rewarded handsomely for all this effort but it’s not something you can just learn overnight.

You’ll need to have a look at your own country’s requirements before deciding what path to go down. It can also sometimes vary by state level. We’ve gone with the normal route for accountants in the United States but you’ll find it’s a similar process in most other countries. Accountants are core to how organisations run, so you’ll need to be highly skilled before you get near anyone’s books.

Usually you start with a bachelor’s degree with a major in accounting, although this isn’t hugely important as long as you take a maths and economics based major. Many colleges and universities offer accounting specific courses. A master’s degree in accounting and relevant government certification will give you greater earning potential, and fulfil the requirements to be a Certified Public Accountant (CPA). Many countries (and organisations themselves) also require some work experience.

Of course, taking a short accounting course online can help you in other areas of work where bookkeeping is important. We must emphasise that you cannot legally trade as an accountant from this but, if you’ve got your own business and need a hand on how to keep records, it’s still a super valuable skill. There are also plenty of resources online to help you learn more and connect with licensed professionals.

What jobs require knowing accounting and bookkeeping as a Digital Nomad?

Accountant is the obvious career here and you’ll need to know your stuff. It’s known as a well paid job but that’s because it takes a lot of training. Accountants can work for a whole host of companies so it might also be worthwhile thinking about what kind of work you want to do. Everyone, from corporate law firms to jetsetting travel businesses, requires an accountant at some point.

Auditors are slightly different from accountants in that they work for an external organisation and visit other organisations to check their bookkeeping and produce reports on their accounts. This is a good job if you want some variety in your work. You’ll usually get to travel around as an auditor (though this will be limited to your country or state) and work with all kinds of businesses.

If you don’t want to be an accountant there are still some other jobs that benefit from bookkeeping skills. Clerical work will benefit from a basic understanding of accounting. Receptionists are just as involved in keeping records of income and expenditure, and knowing how to record this accurately will ensure you shine at your job.

Finally, and one of the main reasons many people take online accounting courses, you’ll also find it super beneficial for running your own business. Accountants are expensive but there are some things you just can’t get wrong. Keeping accurate books is essential to ensuring you don’t get in trouble with taxation authorities.

Average salary for digital nomads accountants

Accountants are among the best paid members of the labor force in the United States. The average salary is $54k and you can expect to earn this within just 1-2 years of working in the job. Entry level salaries are generally over $40k- and this can extend to well over $120k for senior accountants with heaps of experience.

Auditors generally earn more as they require a broader range of knowledge. That being said, it’s unusual for auditors to not at least have some experience as an accountant under their belt. The average salary for an auditor is $59k, stretching from $42k at entry level and going all the way to $140k+ for a senior auditor with a decade of experience.

A receptionist can look to earn an additional $15k with a solid understanding of bookkeeping. This makes it one of the best ways to enhance your income without going through an entire degree programme. You’ll need some solid evidence of your knowledge to prove yourself but this can easily be done if you’ve taken the time to learn.

Most importantly, what about digital nomads that opt to work on the road? Whilst some employers will allow this (especially if you’ve been working there a while), it’s generally preferable for the accountant to stay in the office. Auditors can travel but usually only within their own country.

If you’re taking a freelance role it’ll usually only be for the short term. These can vary from $24/hour for entry level experience, up to $150+/hour for years of experience.

How common are using accounting and bookkeeping amongst digital nomads?

It should be more common! Accounting takes a lot of time to become qualified in and it’s hard to do whilst on the road. It’s therefore really not that common for digital nomads to work in the role. That doesn’t mean you shouldn’t learn it, however – as even those on the road need to pay taxes somewhere (especially if you’re from the United States).

That being said, it’s becoming more common for businesses to allow accountants to work remotely. Clerical work can also mostly be done remotely these days, so having a basic bookkeeping course will keep you ahead of other candidates.

Accounting and bookkeeping are essential skills for any business owner. If you do decide to go into a career in these areas you’ll also find them among the best paid in the world. Taking a basic bookkeeping course is a great way to figure out if it’s for you, as well as keep yourself in the taxman’s good books.

Responses