Revolut Review 2026 – Is It the Best Multi-Currency Account for You?

Revolut has emerged as one of the most innovative providers in the digital banking space. It offers a comprehensive multi-currency solution with a wide array of financial options. With its sleek interface and extensive feature set, Revolut appeals to people looking for an all-in-one financial app that handles everything from daily spending to international transfers. The platform has gained significant traction among tech-savvy consumers, particularly digital nomads, frequent travelers, and frequent travelers.

Revolut combines competitive exchange rates with a suite of banking services, investment options, and lifestyle perks—all accessible through a single app. Its tiered subscription model allows users to choose features based on their needs. These range from free basic accounts to premium packages. Is Revolut the best option for managing multiple currencies? Let’s take a deep dive into its features, fees, pros, and cons to help you determine if it’s the right financial solution for your international money needs.

Overview: What is Revolut?

History & Background

Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, Revolut started as a travel card offering interbank exchange rates. Since then, it has evolved into a comprehensive financial platform valued at over $33 billion. Headquartered in London, Revolut now serves more than 50 million customers globally, adding 10 million customers in 2024 alone.

Core Features

Unlike traditional banks, Revolut operates entirely digitally, without physical branches. It distinguishes itself by offering a “financial super app” that combines multi-currency accounts, cryptocurrency exchange, stock trading, savings vaults, budgeting tools, and lifestyle features—all integrated within a single platform.

How It Works

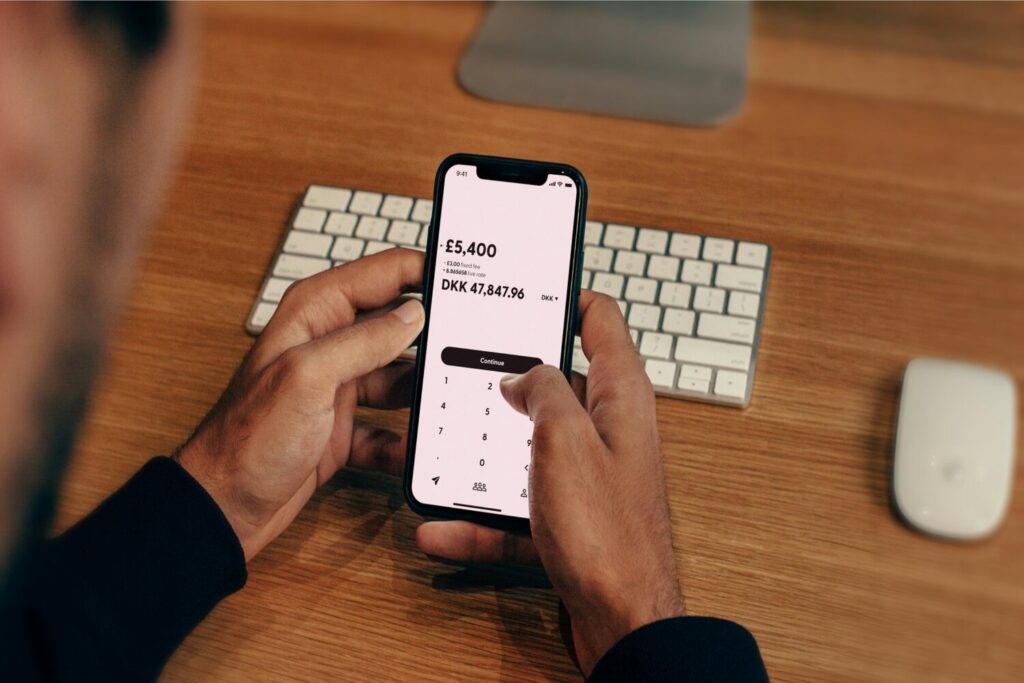

Customers create a Revolut account that acts as a hub for all financial activities. They can instantly exchange between supported currencies, send money internationally, make purchases with physical and virtual cards, and access additional services like insurance and commodities trading. The platform functions through a mobile-first approach with supporting web interfaces.

Who It’s For

Revolut caters to globally minded individuals that need financial flexibility, including frequent travelers, digital nomads, expatriates, cryptocurrency enthusiasts, and those looking for modern alternatives to traditional banking. Its business accounts also serve startups and SMEs with international operations.

Key Features of Revolut

Multi-Currency Support

Revolut allows users to hold, exchange, and transact in 36 currencies in-app. Users can create dedicated accounts in major currencies like USD, EUR, GBP, AUD, and many others. The platform facilitates spending in 150+ currencies worldwide through its card services and international transfers to 160+ countries.

Exchange Rates & Fees

Revolut typically offers interbank exchange rates during weekdays for standard exchanges up to set limits (varying by subscription tier). Weekend exchanges incur a 1% markup for most currencies (2% for less common ones), and exchanges exceeding monthly allowances incur a 0.5-1% fee. Premium and Metal subscribers enjoy higher fee-free exchange limits than Standard users.

Investing

Revolut allows you to invest in 2500+ stocks commission free within your monthly allowance. You can also purchase gold, silver, platinum, and palladium within the app and purchase as you spend with automatic round-ups. In addition, you can also invest in 210+ carefully vetted crypto coins and tokens.

International Transfers

Transfers between Revolut users (“Revolut-to-Revolut”) are instant and free regardless of currency. External transfers use SWIFT or local payment networks depending on the destination with competitive fees that vary by subscription tier. Transfer speeds range from instant to 3-5 business days depending on the currency and destination country.

Account Management

Revolut’s highly-rated mobile app provides comprehensive control over your finances. This includes instant spending notifications, category-based analytics, budgeting tools, and savings features like round-ups and vaults. The interface allows easy switching between currencies and account types, with customizable security settings.

Security & Regulation

Revolut operates under various regulatory frameworks depending on the region. In the UK, it holds a banking license through the Bank of Lithuania and is regulated by the Financial Conduct Authority.

Fees & Costs

Account Fees

Revolut offers a tiered subscription model in Europe:

- Standard: Free account with basic features and lower limits

- Plus: €3.99/month with higher limits and additional features

- Premium: €8.99/month with expanded services and priority support

- Metal: €15.99/month with maximum limits and exclusive perks

- Ultra: €45/month with the highest limits and most exclusive perks (price goes up to €50 after the first month)

In the United States, the following card tiers are available:

- Standard: Free account with basic features and lower limits

- Premium: $9.99/month with expanded services and priority support

- Metal: $16.99/month with maximum limits and exclusive perks

Currency Conversion Fees

Standard and Plus users get fee-free exchanges up to $1,000 monthly, Plus, Premium, Metal, and Ultra users get unlimited currency exchanges with no additional fees (Monday-Friday). All tiers incur 1% weekend markup (2% for less common currencies) to hedge against market volatility.

Withdrawal & Deposit Fees

ATM withdrawals are free up to monthly limits (€200 for Standard and Plus, €400 for Premium, €800 for Metal, and €2,000 for Ultra), after which a 2% fee applies. Most deposit methods are free, though credit card top-ups incur a 2.5% fee in most regions.

Transaction Fees

Domestic transfers are typically free. International transfers outside the SEPA region incur fees starting at $3 for Standard users, with reduced or waived fees for higher subscription tiers depending on frequency and amount. Revolut-to-Revolut transfers remain free across all tiers regardless of currency.

Hidden Costs

While generally transparent, users should note the weekend exchange markup, delivery fees for physical cards, and potential inactivity fees after 12 months without account activity. Some advanced features like disposable virtual cards and premium travel insurance are restricted to higher subscription tiers.

Pros & Cons

Pros

- Comprehensive all-in-one financial platform beyond just currency exchange

- Competitive exchange rates during weekdays with transparent fee structure

- Instant, free transfers between Revolut users worldwide

- Advanced budgeting and spending analytics tools

- Integrated investment options (stocks, crypto, commodities)

- Multiple virtual and physical card options with enhanced security features

- Additional perks like travel insurance and airport lounge access on premium tiers

- Regular feature updates and continuous platform evolution

Cons

- Weekend exchange rate markup can be costly for large transactions

- Free tier has significant limitations on usage and features

- Customer service quality varies, with priority support only for premium tiers

- Some advanced features require paid subscriptions

- Occasional account freezes during compliance reviews

- Not fully available in all countries with regional feature limitations

- Higher subscription costs compared to some competitors

How to Open an Account

Opening a Revolut account is straightforward:

- Download the Revolut app from the App Store or Google Play

- Enter your phone number and follow the verification process

- Provide personal details including name, address, and email

- Verify your identity by taking a selfie and photographing a government-issued ID (passport, driver’s license, or national ID card)

- Choose your subscription plan (you can start with Standard and upgrade later)

- Top up your account using a bank transfer, debit card, or other supported methods

- Order your physical card if desired (virtual cards are immediately available)

The verification process typically takes minutes to complete, with most users gaining immediate access to basic features. Physical cards typically arrive within 9-14 business days, though express delivery options are available in most regions. Business accounts require additional documentation including company registration and ownership information.

Who Should Use Revolut?

Revolut is particularly valuable for those regularly crossing borders and digital nomads who can appreciate the ability to receive, hold, and spend multiple currencies while accessing financial services regardless of their location. It is also appealing to investors interested in dabbling in stocks, cryptocurrencies, and commodities benefit from the integrated investment platform with relatively low fees.

If you live an international lifestyle, frequently deal with multiple currencies, or want to consolidate financial services in one platform, Revolut will feel just like its name – a revolution—especially at the Premium or Metal tiers where the additional benefits often outweigh the subscription costs.

Competitor Comparison

Let’s look at Revolut compared to other platforms:

Revolut vs. Wise – While Wise offers consistently better exchange rates with no weekend markups, Revolut provides a more comprehensive financial ecosystem including investments, savings features, and insurance products. Wise excels in pure currency exchange and international transfers, while Revolut offers a broader range of banking services.

Revolut vs. N26 – Both are digital banks with multi-currency capabilities, but Revolut offers more currencies and exchange features. N26 provides more traditional banking services in its core European markets, including better interest rates on deposits, while Revolut excels in international features and investment options.

Revolut vs. Traditional Banks – Revolut significantly outperforms traditional banks on exchange rates, international transfer fees, and digital features, though established banks offer more comprehensive lending products, higher deposit protection, and physical branch services.

For your information, we created an overall comparison of digital nomad banking options.

Conclusion: Is Revolut Worth It?

Revolut really feels like it can do just about everything in the financial world. Its greatest strengths lie in its versatility, continuous innovation, and ability to serve as a one-stop financial solution for global citizens.

For frequent travelers, digital nomads, and those regularly dealing with multiple currencies, Revolut’s Premium, Metal, or Ultra subscriptions deliver significant value through low or no fees, increased exchange limits, and additional perks that can quickly offset the monthly cost. The free Standard tier provides a good entry point but comes with substantial limitations that may frustrate active users.

However, if you primarily need the best possible exchange rates for currency conversion and international transfers without additional banking features, specialized services like Wise may offer better value.

The final verdict: If you value convenience, a variety of features, and integrated financial services across borders, Revolut is an excellent choice that continues to improve with regular updates. However, compare subscription tiers carefully against your specific needs to determine whether the premium features justify the monthly cost.

Thinking of signing up? Check out their website and compare subscription options before deciding, focusing particularly on the features and currency pairs most relevant to your lifestyle and financial needs.

Responses