Wise Review 2026 – Is It the Best Multi-Currency Account for You?

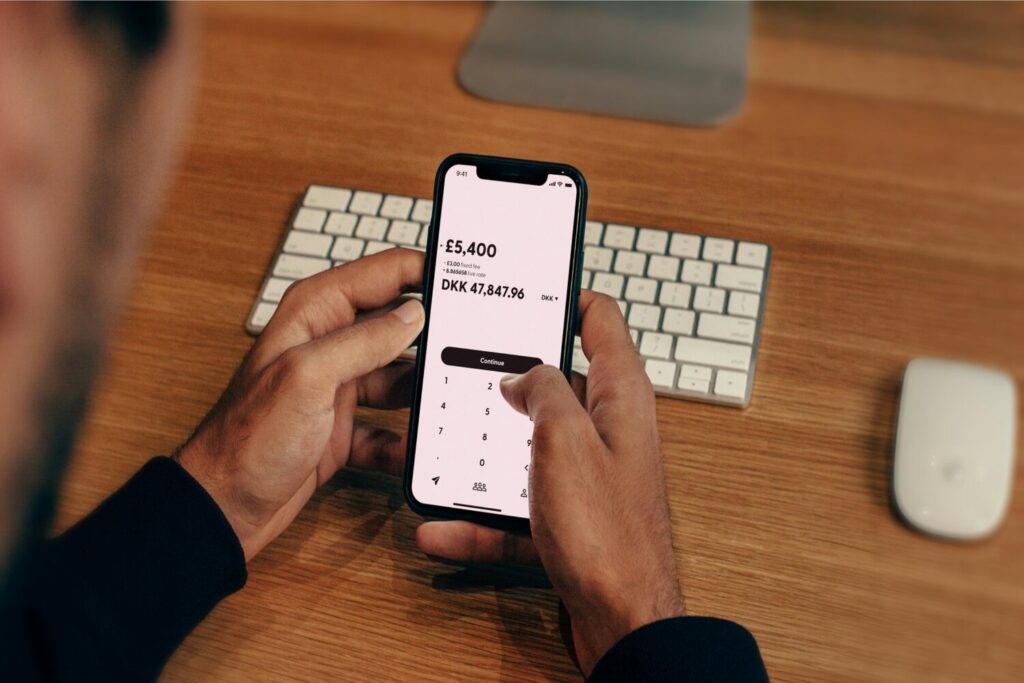

Wise (formerly TransferWise) is far and away one of the most popular multi-currency banking solutions for world travelers and people who need to transfer money across borders and currencies. Known for its transparent fee structure and competitive exchange rates, Wise’s streamlined platform appeals particularly to freelancers working with international clients, digital nomads hopping between countries, businesses engaged in global commerce, and frequent travelers tired of exorbitant foreign transaction fees. Wise’s core promise centers on simplifying international finance through user-friendly services that make sending, receiving, and holding multiple currencies both affordable and straightforward. Is Wise the best option for managing multiple currencies? Let’s take a deep dive into its features, fees, pros, and cons to help you determine if it’s the right financial solution for your international money needs.

Overview: What Is Wise?

History & Background

Founded in 2011 by Estonian entrepreneurs Kristo Käärmann and Taavet Hinrikus, Wise (rebranded from TransferWise in 2021) was born out personal frustration with high bank fees for international transfers. Now valued at over $11 billion, Wise serves millions of customers globally and moves billions monthly across borders.

Core Features

Unlike traditional banks, Wise operates without physical branches, focusing instead on digital-first financial services. Its peer-to-peer model initially revolutionized currency exchange by matching users exchanging money in opposite directions, bypassing traditional banking networks and their associated fees.

How It Works

Users can send money internationally, receive payments in multiple currencies, convert between currencies, and hold balances in a Wise multi-currency account. Transfers typically process through local banking networks rather than expensive SWIFT systems, reducing costs significantly.

Who It’s For

Wise serves individuals and businesses needing efficient cross-border financial services, particularly freelancers, digital nomads, international businesses, expats, and frequent travelers.

Key Features of Wise

Multi-Currency Support

Wise offers remarkable currency flexibility with support for holding balances in 50+ currencies and sending money to 170+ countries. This extensive network allows users to operate globally without maintaining multiple bank accounts across different countries.

Exchange Rates & Fees

One of Wise’s standout features is its commitment to transparency. Unlike many competitors, Wise consistently offers the mid-market exchange rate (the same rate you’d see on Google or XE.com) without hidden markups. Instead, they charge a clear, upfront fee that typically ranges from 0.35% to 1.5% of the transaction amount, depending on the currency pair.

International Transfers

Transfers through Wise are notably faster than traditional banking channels. Approximately 45% of transfers arrive instantly, and 80% within 24 hours. The platform maintains high transfer limits suitable for most users, though these vary by country and currency pairs. Each transfer includes accurate delivery time estimates based on real-time processing conditions.

Account Management

Wise offers a highly intuitive web interface and mobile app (iOS and Android) with consistent high ratings. The platform provides comprehensive account management features including spending analytics, instant notifications, and easy currency conversion. Customer support is available through multiple channels including chat, email, and phone, though response times can vary during peak periods.

Security & Regulation

Wise operates under strict financial regulations in each country where it provides services. In the US, it’s regulated by FinCEN; in the UK, by the FCA; and in the EU, it holds an Electronic Money Institution license. Customer funds are safeguarded in segregated accounts at tier-one banks, and the platform employs bank-grade security measures including 2FA, encryption, and advanced fraud monitoring systems.

Fees & Costs

Account Fees

Opening and maintaining a Wise multi-currency account is free, with no monthly or annual maintenance charges. Business accounts follow the same no-fee structure for basic services, though they offer premium features for additional costs.

Currency Conversion Fees

Wise charges a variable fee between 0.35% and 1.5% for currency conversions, significantly lower than most banks’ 3-5% hidden markup. Popular currency pairs like USD to EUR have the lowest fees, while less common pairs may incur slightly higher charges.

Withdrawal & Deposit Fees

ATM withdrawals are free for the first £200 (or equivalent) per month, after which a 2% fee applies. Wise allows two free ATM withdrawals monthly, with subsequent withdrawals costing £0.50 each. Local deposits via bank transfer are typically free, though some funding methods like credit cards may incur additional charges (typically 0.3-3% depending on the payment method and country).

Transaction Fees

Receiving money into your Wise account in most major currencies is free. Sending money internationally incurs the transparent conversion fee mentioned earlier, with no additional hidden charges.

Hidden Costs

Wise largely eliminates the hidden charges typical of traditional banks, though users should note potential fees for certain deposit methods and for exceeding ATM withdrawal limits. Additionally, receiving payments in certain less common currencies may incur small receiving fees.

Pros & Cons

Pros

- Consistently offers mid-market exchange rates without hidden markups

- Significantly lower fees than traditional banks for international transfers

- User-friendly platform with excellent mobile app

- Supports 50+ currencies and sends to 170+ countries

- Real bank details for receiving money in 10 major currencies

- Highly transparent fee structure

- Regulated in multiple jurisdictions with strong security measures

- Quick transfer processing times compared to traditional banks

Cons

- Not available in all countries or territories

- ATM withdrawal limits may be restrictive for high cash users

- Customer service response times can vary during peak periods

- Some less common currencies not fully supported

- No credit facilities or interest-bearing savings products

- Occasional verification delays for new accounts in certain regions

- Limited integration with third-party financial tools

How to Open an Account

Opening a Wise account is straightforward and can be completed entirely online:

- Visit the Wise website or download the mobile app

- Register with your email, Google, Facebook, or Apple account

- Verify your identity by providing your address, birth date, and uploading government-issued ID (passport, driver’s license, or national ID)

- For some countries, you may need to upload proof of address (utility bill, bank statement)

- Make a small initial deposit using a debit card, credit card, or bank transfer to activate your account

- Once verified, you can immediately begin using most features

The verification process typically completes within 1-2 business days, though most users gain access to basic features almost immediately after submitting their documents. Business accounts require additional documentation relating to company registration and ownership structure.

Who Should Use Wise?

Wise offers particular value for:

Digital Nomads & Remote Workers

Those working internationally while traveling benefit from Wise’s ability to receive payments in multiple currencies without establishing bank accounts in each country.

Freelancers with International Clients

Receiving payments in clients’ local currencies without conversion penalties makes Wise ideal for global freelancers.

Expats

Individuals living abroad who need to manage finances in both their home and resident countries find Wise’s multi-currency capabilities invaluable.

Small to Medium Businesses

Companies engaged in international trade appreciate Wise’s transparent fees and business-specific features like batch payments and accounting integrations.

Frequent Travelers

If you regularly visit multiple countries, Wise’s multi-currency debit card offers significant savings on foreign transaction fees compared to traditional bank cards.

If you receive income in one currency but have expenses in another, or frequently transfer money internationally, Wise provides substantial cost savings and convenience over traditional banking options.

Competitor Comparison

When compared to other multi-currency platforms:

Wise vs. Revolut – While Revolut offers more banking features and cryptocurrency trading, Wise typically provides better exchange rates on weekdays. Revolut adds markups on weekends and for certain currency pairs, whereas Wise maintains consistent transparent pricing. Revolut’s free tier has more usage limitations than Wise’s standard account.

Wise vs. Payoneer – Payoneer better serves marketplace sellers (Amazon, Upwork, etc.) with direct integrations, but Wise offers superior exchange rates and lower fees for general transfers. Payoneer provides more localized payment methods in certain regions, though Wise generally offers faster processing times.

Wise vs. PayPal – PayPal has wider global acceptance for payments, but Wise significantly outperforms on exchange rates and fees, often saving users 3-4% on international transfers. PayPal’s convenience comes at a substantial premium for currency conversion.

Wise vs. Traditional Banks – Wise consistently beats traditional banks on both exchange rates (typically 2-4% better) and transfer fees (often 80-90% cheaper), though banks offer more comprehensive financial services like loans and investments.

For pure currency exchange and international transfers, Wise generally offers the best combination of competitive rates, transparency, and usability among its competitors.

Conclusion: Is Wise Worth It?

Wise stands out for offering genuinely competitive exchange rates with transparent fees in an industry often characterized by hidden charges. Its strongest selling points include mid-market exchange rates, low transfer fees, and an intuitive user experience across multiple platforms.

For those regularly dealing with multiple currencies, Wise delivers exceptional value and convenience. Its ability to provide local bank details in major currencies eliminates the complexity of international banking for many users.

However, if you rarely make international transfers or need comprehensive banking services like loans, credit cards with rewards, or interest-bearing accounts, you might find Wise’s offerings limited compared to traditional banks or neobanks like Revolut.

The final verdict: If you need affordable, transparent international money management, Wise is currently the market leader. However, if you prioritize all-in-one banking with additional financial products, consider complementing Wise with services from traditional banks or more comprehensive fintech alternatives.

Thinking of signing up? Check out their website and compare options before deciding, especially focusing on the specific currency pairs and features most relevant to your needs.

Responses